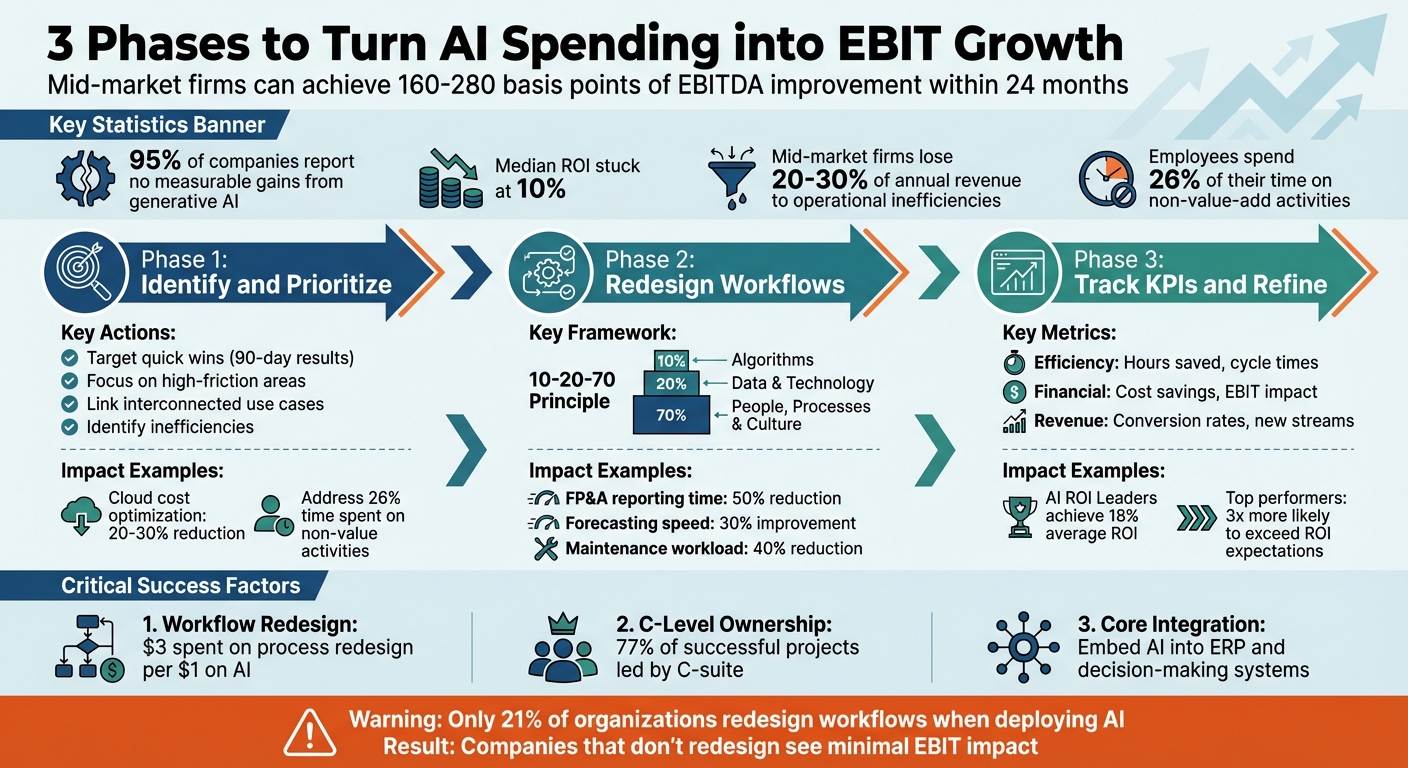

Mid-market firms are investing heavily in AI but often see little financial return. According to recent data, 95% of companies report no measurable gains from generative AI, with median ROI stuck at 10%. The problem? AI is treated as a plug-and-play tool rather than a driver for process transformation.

To translate AI spending into EBIT growth, companies must focus on:

- Identifying high-impact opportunities: Target inefficiencies like manual tasks and redundant processes.

- Redesigning workflows: AI works best when integrated into restructured operations, not tacked onto old systems.

- Tracking KPIs: Link AI-driven improvements directly to financial outcomes like cost savings and revenue growth.

Success requires leadership commitment, clear accountability, and a focus on measurable results. Firms that effectively integrate AI into operations can see EBITDA improve by 160–280 basis points within two years.

3 Phases to Turn AI Spending into EBIT Growth for Mid-Market Firms

3 Phases to Turn AI Spending into EBIT Growth

Transforming AI investments into EBIT growth isn’t just a possibility - it’s a strategic opportunity. Mid-market firms that adopt a phased approach can see 160 to 280 basis points of EBITDA improvement within 24 months. The secret lies in following three interconnected phases: exploration, implementation, and optimization. Each step builds on the previous one, driving measurable financial outcomes.

Phase 1: Identify and Prioritize High-Impact AI Opportunities

The journey starts with identifying quick wins - AI implementations that deliver measurable results within 90 days. These early successes build confidence across the organization and create momentum for larger initiatives. The focus should be on core business processes where AI can make a real difference, rather than peripheral tasks that won’t significantly impact EBIT.

Here’s a staggering stat: employees in mid-market firms spend 26% of their time on non-value-add activities. Tasks like exception-heavy accounts payable or revenue cycle management are ripe for AI intervention. Unlike older automation tools like basic RPA, modern AI tools excel in handling these complex, high-friction areas.

Another smart move? Look for interconnected use cases where data and technology investments can be reused. For instance, if you’re deploying AI for cash application, the same infrastructure can support accounts receivable forecasting. These linked applications reduce manual effort and improve efficiency across multiple functions.

The financial benefits are hard to ignore. Mid-market companies lose 20 to 30% of annual revenue to operational inefficiencies. Quick wins - such as AI-powered cloud cost optimization that cuts infrastructure expenses by 20 to 30% - can free up funds to fuel larger, transformative projects.

Once these high-impact opportunities are pinpointed, the next step is to redesign workflows for deep AI integration.

Phase 2: Redesign Workflows During Implementation

Implementing AI without rethinking workflows is a missed opportunity. To ensure long-term success, follow the 10-20-70 principle: allocate 10% of effort to algorithms, 20% to data and technology, and 70% to people, processes, and cultural improvements.

A great example of this is a global consumer goods company that, in June 2025, revamped its Financial Planning and Analysis (FP&A) department. By building a driver-tree model that linked operational metrics to financial outcomes and layering it with a GenAI-powered natural language interface, the company reduced reporting time by 50% and improved forecasting speed by 30%. This kind of redesign not only streamlines operations but also ties workflows directly to EBIT outcomes.

Leading organizations go beyond simple automation. They reimagine key functions, using AI to create new value instead of just improving existing processes. This holistic transformation accelerates decision-making and reduces costs, directly impacting EBIT. The difference between marginal efficiency gains and transformative growth often comes down to how well workflows are redesigned.

Phase 3: Track KPIs and Refine for Better Returns

To sustain and amplify the gains from AI, tracking key performance indicators (KPIs) is essential. Focus on efficiency metrics like reduced manual workload, hours saved, and shorter cycle times. Link these directly to financial outcomes such as lower costs to serve and improved EBIT. For example, calculate labor savings by multiplying hours saved by hourly rates, and decide how to reinvest those resources - whether by boosting sales capacity, reducing headcount, or enhancing customer service.

Start by establishing a baseline. Conduct a process decomposition exercise using 8 to 12 weeks of historical data to capture current time, cost, volume, and error rates. Without this baseline, it’s impossible to measure ROI effectively.

Revenue and growth metrics are equally important. Monitor changes like higher conversion rates, increased average order values, and new revenue streams enabled by AI. For instance, Goldman Sachs Asset Management deployed generative AI assistants in 2025, boosting client outreach efficiency by 30% through features like next-best-action recommendations and automated document summaries.

Even intangible benefits, such as reduced resource loads or improved forecasting accuracy, can be measured using proxies. While the median ROI for AI in finance functions is around 10%, top-performing companies - dubbed "AI ROI Leaders" - achieve an average ROI of 18%, well above the typical 10% cost of capital hurdle.

AI Applications That Actually Improve EBIT

The difference between pouring money into AI and seeing tangible results often hinges on how and where the technology is applied. By rethinking workflows and aligning KPIs, targeted AI solutions can deliver real results. Mid-market companies focusing on three areas - process automation, predictive analytics, and customer personalization - often see noticeable EBIT improvements in just a few months.

Process Automation for Cost Reduction

Automating back-office processes can immediately cut costs by eliminating repetitive, manual tasks. For example, from 2024 to 2025, IBM saved around $3.5 billion and boosted enterprise productivity by 50% in areas like legal, IT, procurement, and HR by completely reengineering operations with AI and automation.

In procurement, a global pharmaceutical company used generative AI to verify supplier invoices. Within just four weeks, this uncovered over $10 million in value leakage - about 4% of the analyzed spend - with 95% accuracy in extracting line items from PDFs.

But the benefits of automation go beyond procurement. AI-powered customer support tools can manage high volumes of inquiries, cutting call center costs by as much as 90%. Similarly, AI-driven optimization of field operations, such as maintenance or sales team workflows, can increase individual productivity by 20% to 30%. While these tools reduce costs, they also improve forecasting, further enhancing EBIT.

Predictive Analytics for Better Forecasting

AI-powered forecasting can drastically reduce waste, avoid stockouts, and optimize resource use. For instance, AI-driven capacity planning can slash infrastructure overprovisioning by 30% to 50%, and predictive monitoring can prevent 70% of potential system outages. In logistics, AI routing engines lower cost-to-serve by up to 20% - a crucial factor for mid-market distributors and industrial firms.

Procurement teams leveraging AI analytics typically cut their purchasing costs by 8% to 12%. In deal sourcing, AI simplifies the process of identifying high-potential investment opportunities. According to the World Economic Forum:

In deal sourcing, AI can identify 195 relevant companies in the time it would take a junior analyst to evaluate one.

Companies using AI for deal sourcing report a 10% to 15% boost in lead quality and a 20% drop in acquisition costs.

The real advantage comes when predictive analytics is tied directly to core business operations. For example, a global biopharma company implemented generative AI across three functions in 2025. In R&D, it cut clinical study report drafting time by 35%, from 17 weeks down to 10-12 weeks. In manufacturing, it reduced product quality review drafting time by 70% to 90%. These efficiencies freed up resources for strategic initiatives while accelerating product launches. Beyond cost savings, AI also opens up opportunities for revenue growth through personalization.

Customer Personalization for Revenue Growth

AI-driven personalization enhances revenue by improving conversion rates, increasing average order values, and lowering customer acquisition costs. For example, in April 2025, UK fashion retailer White Stuff introduced AI-powered product discovery, which led to a 21% jump in search conversion rates and an 8% increase in average order value. Similarly, Fisheries Supply, a marine parts distributor, used AI-powered search to help technical buyers find specific parts, resulting in a 15% boost in revenue per user.

AI also transforms marketing efficiency. In December 2025, a Fortune 500 automotive company used the Typeface platform to create personalized ad variations for a year-end sales event. The team delivered 4x more tailored ad creatives and launched the campaign 52% faster than with manual methods. Personalized campaigns can make marketing budgets stretch further, improving spend efficiency by nearly 30%. Plus, AI-driven ad personalization can cut cost-per-variant by 50% to 70% after just a few campaigns.

sbb-itb-34a8e9f

Why Workflow Redesign Determines AI Success

AI tools on their own don’t magically improve EBIT - they only amplify the flaws in existing processes. Workflow redesign stands out as the most critical factor influencing EBIT impact from generative AI. Yet, only 21% of organizations actually take the time to rethink their workflows when deploying AI. The rest? They simply tack AI onto their current processes and then wonder why the results fall flat.

Here’s the reality: for every dollar invested in AI, companies need to spend $3 on redesigning their processes to unlock true value. Businesses that tailor AI solutions to fit their core processes are three times more likely to exceed ROI expectations. Chris Wegmann, Managing Director at Accenture AWS Business Group, puts it bluntly:

AI is a very expensive band-aid to a bad process.

Top-performing companies don’t just dip their toes into AI - they dive deep, targeting transformations at the domain level to overhaul entire functions or customer experiences. Take, for example, a global heavy-industry manufacturer that, in March 2025, deployed a generative AI-powered maintenance copilot. By redesigning the entire maintenance workflow, frontline workers could pinpoint the root causes of equipment failures - tasks that previously required specialized automation experts. The result? A 40% reduction in maintenance workload and a 3% improvement in overall equipment effectiveness.

This kind of success underscores the need for a complete process overhaul, which naturally leads to strategies for defining ownership and deeply embedding AI into your operations.

Setting Clear Ownership and KPIs

Once workflow redesign is on the agenda, the next step is ensuring accountability and setting measurable goals. Without clear ownership, AI initiatives risk fading into irrelevance. 77% of successful AI projects are led by C-level executives, and 44% of leading companies have CEO or board-level sponsorship. Without this high-level backing, AI projects often stall when they encounter resistance or unclear ROI timelines.

Ownership isn’t just about assigning someone to oversee the project. It requires a C-suite leader - often the COO, CIO, or CTO - who has both the technical knowledge and the authority to drive change. A great example is JPMorgan Chase, which automated 360,000 hours of legal work annually with its "COiN" system under the direct leadership of CEO Jamie Dimon. This initiative cut legal operation costs by 30% and reduced compliance errors by 80%. Achieving this level of impact requires unwavering commitment from the top.

To measure success, KPIs need to tie directly to EBIT drivers like margin improvement, cost savings, or working capital optimization - not just project milestones. A small "Value Mission Control" team can track how AI-enabled workflows are performing, connecting process metrics directly to profit and loss outcomes. Without this connection, you’re just tracking activity, not results.

Integrating AI into Core Business Processes

Redesigning workflows is just the beginning - AI must be seamlessly integrated into your core systems to deliver real value. Systems like ERP (Enterprise Resource Planning) are especially crucial because they house the "operating DNA" - the process knowledge and business rules - needed for AI to scale effectively. Bjørnar Jensen, Senior Partner at McKinsey & Company, emphasizes:

Unlocking AI's full potential requires treating ERP not as legacy baggage but as a key enabler that makes intelligence scalable, safe, and valuable.

Integration means embedding AI into the actual decision-making processes - approvals, forecasting, resource allocation - rather than using it as a standalone tool. For instance, in August 2025, a global pharmaceutical company implemented generative AI to verify supplier invoices against complex contracts. By integrating AI directly into their procurement workflow, they uncovered over $10 million in value leakage - roughly 4% of the analyzed spend - in just four weeks. The key? The AI wasn’t just flagging issues; it was built into the system where procurement decisions were made.

To make this work, you need a detailed map of your workflows. Bring together domain experts and AI specialists to walk through the processes step by step, identifying the specific data tables and business rules the AI needs access to. This approach avoids the common pitfall of deploying AI tools without a clear understanding of how work actually flows in your organization.

Conclusion: From AI Spending to Measurable EBIT Results

The gap between what companies spend on AI and the returns they see often boils down to how well they manage transformation. While many organizations have embraced AI, only a small fraction achieve a measurable impact on EBIT. The difference? It lies in three key areas: redesigning workflows effectively, establishing clear ownership, and tying measurable KPIs directly to profit.

Without addressing these areas, companies risk deploying AI solutions that simply automate broken processes. The real winners are those that treat AI as a tool for rethinking processes entirely, not just as a way to make flawed workflows faster. These insights pave the way for practical next steps.

What to Do Next

To start, focus on cost-reduction use cases to free up resources for future growth. High-performing companies tend to go deeper rather than wider, prioritizing an average of 3.5 use cases, compared to 6.1 use cases for companies that underperform. Concentrate on workflows where AI can eliminate inefficiencies entirely, rather than just improving them incrementally.

Before rolling out any AI solutions, establish clear baselines. Use process analysis to document current metrics like time, cost, and quality. As Robert Wilmot, Managing Partner, Canada, IBM Consulting, wisely points out:

"If you don't know your starting point, you can't measure ROI."

Without a clear understanding of where you're starting from, assessing the impact of AI becomes nearly impossible.

Next Steps for Mid-Market Leaders

For mid-market leaders, the next move is to take these foundational steps and focus on leadership-driven transformation. Begin by auditing your AI initiatives and applying a Stop/Start/Scale framework. Many companies struggle to scale AI pilots, leaving promising projects stuck in limbo. Ask yourself: Which initiatives are driving measurable EBIT impact, and which are failing to progress?

C-level ownership is critical for success. Executive sponsorship ensures that top-priority projects can overcome internal resistance and navigate unclear ROI timelines. Additionally, take a "string-of-pearls" approach by linking related use cases. This allows your data and technology investments to be reused across initiatives, compounding their benefits over time.

Ultimately, turning AI investments into measurable EBIT growth requires a commitment to rethinking workflows, assigning clear accountability, and focusing on initiatives that offer the greatest potential for impact.

FAQs

How can mid-market companies identify AI projects that drive real EBIT growth?

Mid-market companies have a real chance to make AI work for them by identifying where it's already in play and aligning those efforts with their business goals. The first step? Take a close look at how AI is being used in areas like sales, pricing, supply chain, and risk management. This audit helps pinpoint spots where AI adoption is high, but the results aren't adding up. From there, focus on use cases that promise the biggest returns - whether that's boosting revenue, cutting costs, or being straightforward to implement.

Success hinges on moving quickly but thoughtfully. Use short, iterative sprints to figure out which projects to push forward, which to pause, and which to scale. Make sure AI's results tie directly to profit-and-loss metrics by setting clear KPIs and assigning specific owners to each initiative. To avoid getting stuck in endless pilot programs, integrate AI into reworked workflows and governance systems, ensuring it delivers real, scalable results. With this structured approach, AI investments can lead to tangible EBIT gains.

How can mid-market companies redesign workflows to maximize AI's impact on EBIT?

To fully integrate AI into workflows and boost EBIT, businesses can follow a structured four-step approach:

- Assess and prioritize processes: Start by identifying workflows that are bogged down by bottlenecks or manual tasks. Pinpoint areas where AI can make a noticeable impact, focusing on processes that will deliver measurable results.

- Establish governance and accountability: Define clear roles like AI owners or data stewards to oversee the process. Set standards for data quality, security, and performance monitoring to ensure AI initiatives are managed effectively.

- Integrate AI into workflows: Redesign key processes to incorporate AI at critical decision points. Whether it’s automating repetitive tasks, offering smarter recommendations, or improving decision-making, ensure AI drives real value in everyday operations.

- Pilot, measure, and scale: Begin with small-scale pilots and set clear KPIs - such as cost reduction or revenue growth - to evaluate success. Once proven, scale these initiatives while maintaining oversight and tracking results.

By following this roadmap, mid-market firms can transform AI investments into tangible EBIT gains, bridging the gap between potential and performance.

How can companies measure the financial impact of AI on EBIT?

To evaluate how AI is influencing EBIT, the first step is to establish a clear financial starting point and set specific, measurable goals for each AI project. Pinpoint the process or decision-making area the AI aims to improve, and define key performance indicators (KPIs) such as cutting costs, boosting revenue, or improving efficiency. Then, compare EBIT figures from before and after the AI implementation to gauge progress.

After deploying the AI solution, keep a close eye on those KPIs to ensure the financial impact remains clear and measurable. Adjust for external factors to accurately isolate AI’s contribution, and assign responsibility to team members to maintain accountability. By sticking to clear metrics and disciplined tracking, businesses can translate their AI investments into real EBIT growth.